Over the last few years there has been a significant move towards investing into yield. This may be because of the lower interest rate environment we are in or perhaps its just my clients moving closer (as a group) towards retirement. Either way, it is a large shift from the pre-gfc investment environments.

So as an investor is it better to look for high yielding or high growth opportunities or would it be better to look at total returns?

In March 2009, which in hindsight was the bottom of the GFC. The ASX S&P200 (XJO) was trading at 3145. Currently it is trading at just under 5300 (this follows a recent fall from near 6000 in Mar15). Using a pure capital growth calculation it has regained an impressive 2155 points or provided an increase of 68% if you were lucky enough to have purchased at the bottom. Unfortunately if you bought at the top of the peak (6748 in 2007) you probably still have losses.

If you look at the same time frames on the Accumulation index XJOAI, which is the ASX S&P200 plus dividends reinvested. In March 2009 the XJOAI was 21298, its last price as 47385. This is a gain of 26087 or 122%.

The chart on the right shows a 10 year comparison between the 2 indices. The XJO after 6 years has failed to reach the highs of 2007, but the Accumulation index shows us a completely different result.

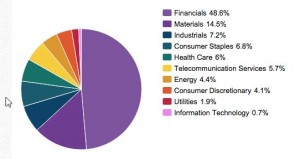

The companies listed on the ASX are predominantly made up of Banks (financials) and Miners (materials) combined they amass over 60%.

The companies listed on the ASX are predominantly made up of Banks (financials) and Miners (materials) combined they amass over 60%.

So for our market to rise in its current form we will need strength in these sectors. With current pricing in commodities we are unlikely to see another mining boom in the next few years, yet better value in commodities is more likely – and the banks are in a pattern of low growth. Considering these facts, unless the sector weight changes happen for our top index we may struggle to get back to the 6000 level where it found resistance earlier in 2015.

From the table above, you can see just a couple of stocks in the top 200. Both CBA and TLS have the highest yield but the overall return for 12 months is negative – Where the other 3, have a low or modest yield but the 1 year returns are very impressive.

So the moral to the story is, unless you are investing for pure yield (meaning you need the income to live off) you will always be better off trying to focus on total returns rather than just the dividend.

![MetaStock - [Chart2 - S&P AUST INDEX ASX 200 INDEX (Trade Price)]_2013-05-24_16-50-03](http://stevesoars.com/wp-content/uploads/2013/05/MetaStock-Chart2-SP-AUST-INDEX-ASX-200-INDEX-Trade-Price_2013-05-24_16-50-03-300x164.jpg)